Photo credit: toledoblade.com & pixabay.com

The Novel Corona Virus/COVID19 pandemic has severely impacted many industries, including travel, hospitality, entertainment/sport, retail, finance, education and many more. Many people can’t wait for the end of “lockdown” and to bounce back to “normal”. We think that’s a bad idea...

Bouncing back to where you were and how you were configured and operating before the pandemic may be problematic, because there will be a new normal. Many changes that were happening before the pandemic have been accelerated, many “impossibles” have become de- facto, and many taboos have been broken. Bouncing back might put you severely at odds with the new context and even threaten your survival.

So what is the alternative? We believe you should take a hard look at what has and is changing and extrapolate that forward to the new normal. You then need to rapidly adapt your business to that new reality so that you can survive and thrive. Survival is about ensuring you can operate during the pandemic and as the world emerges from it. Thrive means being ready for what exists after the pandemic and finding opportunities within it to prosper.

Many things are likely to have changed, including:

Physical distancing will remain in our culture and prevent large gatherings and physical interaction in the work place, education, entertainment, sports, religion and socially

Travel will be reduced to “when necessary” rather than at a whim, or for leisure

Work from home will be the new norm for many industries and job roles. Many businesses (e.g. large banks and insurers) who did not contemplate this before, will now see it as a viable model

Products will become more virtual and dynamic. This is an acceleration of a trend that was already there. Witness music, movies, books, theatre and news dematerialising and being delivered on demand via streaming. Vehicles get new capabilities via automated updates over the Internet

Physical retail shrinks and eCommerce and delivery become the norm

Educators, entertainers, advisors and many others will move to remote delivery of services

Most economies will suffer a major depression following the decreased economic activity during “lockdown”, with several years of “negative growth”. Unemployment will spike, with many small businesses, entrepreneurs, freelancers and gig-economy workers having lost their livelihoods

Money supplies have increased with many governments “printing money” to support business and individuals. Unfortunately, this is not coupled with any increase in output of goods, services or value (quite the reverse, in fact). This is likely to result in high sovereign debt, higher debt servicing costs as a proportion of national budgets and hyper inflation due to more money in the system pursuing the same or less value

Virtualisation, remote working and other trends will generate opportunities for previously local businesses to become global

Governments have curbed freedoms and assumed powers under emergency legislation. Rights and freedoms are likely to take a long time to be fully restored. Governments are likely to have a much larger role in the economy, which they generally do badly. This also equates to higher taxes

Decision cycles will be altered. Some will be slowed down due to uncertainty, others accelerated due to fear, need or altered priorities and relaxed controls

Contracts (legal, social, moral) will be up for renegotiation or irrelevance. Parties may escape their obligations with legal and government sanction, e.g. “Rent Boycotts”. Other parties may have their rights infringed without recourse to justice e.g. Insurers or employers forced to pay for things they never committed to. Some contracts will be renegotiated between reasonable parties e.g. Repayment Holidays, or extended payback periods for borrowers

Surprising new collaborations can arise. This may involve players in an industry who were previously competitors; across industries previously unconnected; or between government and private sector

Relative value of different professions and jobs will shift. Many have a new appreciation for health care workers, teachers and cleaners, for example

Organisations will have to rethink their value proposition and delivery as a result. Some industries have benefitted from the pandemic, e.g. Telecommunications, healthcare, security. Others, including restaurants, theatres, retailers, travel and accommodation and all sorts of other “non-essential” service providers have seen their revenues disappear overnight. Formerly major industries like airlines are suddenly facing closure. Gig-workers such as Uber drivers and entertainers have essentially become unemployed. Creative and lateral thinking may be essential to deal with radically altered realities.

There are some silver linings in the “new normal”, including:

A focus on essentials and real value over the frivolous or political

A worldwide reduction in pollution and pollution-related disease and deaths. Similar reduction in pollutants responsible for global warming

Collaboration versus competition - “we are all in this together”

Boundaries that were previously regarded as inviolate have suddenly become permeable

Remote working and service delivery enables reaching geographies that were previously unavailable, even for very small enterprises

There is an “unfreezing” which makes changes possible that were previously not contemplated

A rethinking of globalisation driven only by economic considerations and a return to more self sufficiency and considering factors other than cost

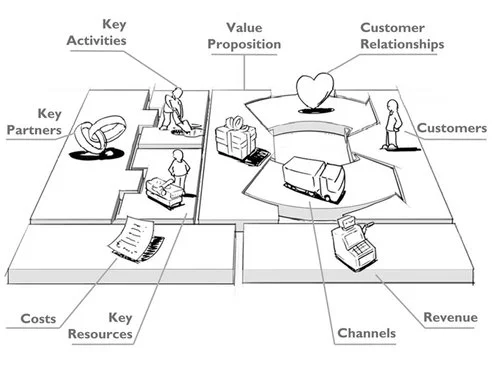

So what is up for grabs / may need to change? Many things, including:

Value proposition

Organisation structure

Customer Interaction

Product and Service Mix

Value chain / network / who we partner with and how

Data required / intensity / immediacy

Technology dependence / infrastructure / platforms

Staff interaction

Legal and contractual arrangements

We suggest that you deeply examine what assets, values and strengths your organisation has and how these can be leveraged in the new normal. These could include:

Expertise / Skill / Experience

Connections & Network

Infrastructure

Platforms

Resources / Reserves / Intellectual Property

Creativity

You may need to adopt the startup mentality of “pivoting” to meet the real needs of customers and opportunities in the market. This may mean emphasising aspects of your business that were previously peripheral, or even adapting skills and capabilities to entirely new needs. It may mean partnering with different players, it may mean completely new product / service configurations or delivery channels. Some examples include:

Previously sit-down restaurants leveraging their kitchens for catering and serving customers through delivery services (outsourced or their own)

Customers keeping favourite local businesses running by making “investments” via vouchers, redeemable at a future date for goods or services at a discount. This may leverage booking or crowd sourcing platforms

Bricks and mortar retailers transitioning to business to consumer (B2C) eCommerce

Delivery of previously physical products (e.g. face to face training) via virtual delivery through video conferencing or full online delivery

Advisory services (consulting, investing, healthcare, coaching... ) delivered remotely via video conferencing

Teaching others how to operate in the new normal i.e. leveraging skills your organisation already has to assist others with things they are grappling with for the first time

Providing products not previously required e.g. helping parents to home school; enabling professionals to work from home; charging seldom used vehicles for owners who are “locked down”; pivoting technologies to new purposes: e.g. using cell phones to track people at risk from proximity to COVID victims, or warn of areas where it has been diagnosed

At Inspired, we have focussed on delivering “Desirable Futures” for over two decades. We are thought leaders in business strategy, agility and architecture. We are preparing a New Normal Readiness Assessment tool to assist you in determining how ready you are (or aren’t!) for the new normal and what to focus on to get ready to Leap Forward instead of bouncing back in an unfit state. Contact us for more info and watch this space!